- The business environment in São Paulo has been challenging, with less developed infrastructure, long bureaucratic procedures, and an uncertain demand outlook.

- However, the difficult environment has not discouraged all companies in São Paulo. Many local companies have found ways to overcome the challenges and have executed their plans in accordance with their long-term strategic views.

Recently, I had the opportunity to visit São Paulo for the first time. During the first few hours of my ride to the hotel, I was welcomed by a vast landscape filled with trees, unfinished bridges, unpainted houses, and people walking next to roads with no paved sidewalks. It was somewhat unexpected to me as I thought that, as a major financial center in Brazil, Saõ Paulo would have been more developed. On the other hand, the roads were filled with cars, probably with foreigners like me, adding energy to the scene. As I have traveled to many cities in emerging market countries, this kind of initial encounter has often provided me with valuable clues as to a country’s general business operational environment, such as its development of basic logistics, its regulatory environment, and the cost of doing business.

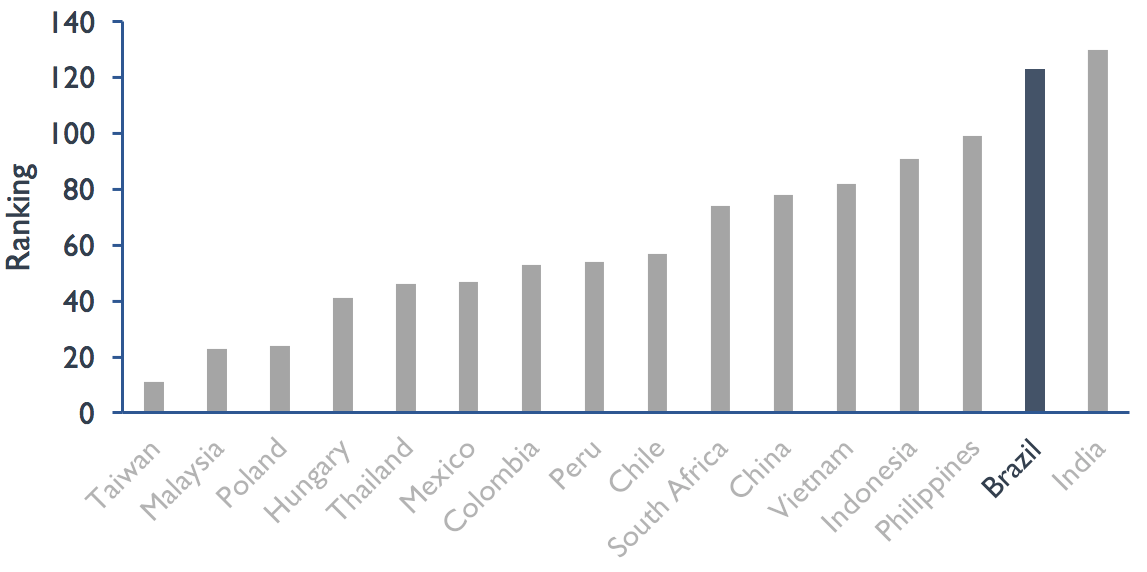

According to the World Bank’s 2017 Ease of Doing Business Report, Brazil is ranked 123rd, low compared to other emerging market countries, as shown in Chart 1. This score covers several key areas, such as dealing with construction permits, paying taxes, and trading across borders. However, these obstacles don’t seem to stop long-term investment into the country as the resilient Foreign Direct Investment (FDI) level in Chart 2 suggests.

Lower score indicates greater ease of doing business

- Source: The World Bank, “Doing Business 2017: Equal Opportunity for All,” Fourteenth Edition, 2017.

- Source: The World Bank, “World Development Indicators.”

- Data as of March 23, 2017.

Further piquing my curiosity, during my visits to two local shopping malls, I came to the realization that good business operators were able to execute their goals even under a difficult economic environment (even as some others failed). Long-term investment probably still comes to Brazil to look for these types of opportunities (as evidenced by continued FDI amid economic recession). Near my hotel, there were two shopping malls. The first one that I visited was rather quiet and empty. Most of the stores were closed, and I could not find any salespeople at the counters. However, the shopping mall adjacent to this one had a completely different atmosphere. It was filled with people. More brands were located inside the mall, including some global brands, and each floor was well organized by category. The shopping environment was more pleasant, with higher ceilings and brighter lights. Given that both malls were in the same location, serving the same community, the difference might be attributed to the disparity in managements’ capability and commitment.

In my subsequent meetings with various management teams, I was able to identify some common characteristics of what made a good business operator. The first was long-term comprehensive planning toward a strategic goal. Because the commodity sector accounts for an important part of Brazil’s exports and the cost of funding is high, the economic environment can be unstable at times. I found that successful companies focus on long-term planning to continuously improve their internal strength, regardless of externalities. For example, one consumer retailer mentioned that its current supply chain management initiative started in 2010. At that time, as the company set up a 10-year store rollout plan, it enacted a long-term supply chain improvement plan to support the growing number of stores in the future and to manage inventory efficiently, enabling the company to deploy capital effectively across stores. To find the right solution, the company’s senior management traveled globally to meet with various leaders in supply chain management and tailored their findings to their own situation.

The second characteristic was a methodical approach toward execution. One commodity producer shared with me that it is now able to monitor each individual machine’s utilization rate from a single remote control room. In addition, its raw material processing lines are connected to sourcing hubs to minimize waste. To implement this efficient management program successfully, the company divided the country into several regions based on processing capacity, and then researched pricing dynamics for several years to calculate the cost base required to ensure profitability over a business cycle. Based on that study, the company generated a detailed list of improvements, and then measured results by comparing profits to the capital deployed by each division. Company management explained further that human resource management, such as hiring and retaining talent, is a crucial part of executing its efficiency plan. The company overcame young workers’ preference for the internet industry by offering programs in career training and professional development.

The final common characteristic was that these successful companies started to build economic ecosystems of their own. One company’s management mentioned that they had begun dispatching engineers to selected suppliers to help them reduce production lead time. Dealing with suppliers is always one of the most challenging parts of logistics. The company’s novel approach was effective in streamlining the workflow between the company and its suppliers, resulting in faster production cycles than its peers. As the company collaborated with suppliers more closely, it also realized opportunities to enhance the quality of the end product. In my view, the construction of such ecosystems is particularly meaningful in emerging countries. Doing so can lead to the establishment of a surrounding industry value chain. Eventually, accumulated industrial knowledge and experience can provide strong intangible power to long-term economic development.

With these types of efforts, good business operators can increase their competitive strength and take advantage of difficult economic situations to expand. Though they remain cautious regarding their overall short-term demand environment, it does not mean that these good business operators will remain “stuck” in their development path. Rather, they have positioned themselves for better growth for years to come, regardless of a challenging external environment.

Later in my trip, I attended a government official’s speech on Brazil’s economy. The topic of the speech was how government could improve the ease of doing business in Brazil. The speaker pointed out that some impractical policies – such as requiring a certain percentage of components be produced locally – have only delayed domestic economic development. Companies struggle because the components they need are not always manufactured in Brazil, or they are not manufactured well at reasonable cost. He also emphasized the need to shorten the investment application and approval processes to stimulate the country’s economy.

On similar “field trips” to various emerging market countries, one of the rewarding experiences is observing the development of an economy over time, manifested by a friendlier business environment and stronger individual company fundamentals. This is something that can only be seen after several visits, as it takes time and effort. As this was my first trip to São Paulo, I hope that I can return someday to witness the city’s continued growth.

Inbok SongSão Paulo

- The views and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writer's current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. Seafarer does not accept any liability for losses either direct or consequential caused by the use of this information.

![[Chrome]](/_layout/images/ua/chrome.png)

![[Firefox]](/_layout/images/ua/firefox.png)

![[Opera]](/_layout/images/ua/opera.png)

![[Microsoft Edge]](/_layout/images/ua/edge.png)