- In hindsight, it is mind-boggling to know my visit to Istanbul was only three blocks and three weeks apart from the chaos that engulfed Taksim Square.

- I did see a few small clues that hinted at public discontent; but honestly, I had no idea that the city would soon be consumed by protest.

- Part of the reason I did not perceive the simmering discontent was because, by every observable measure, Turkey’s economy was performing well, despite numerous headwinds.

- I saw many young people in the streets, but nearly all appeared carefree and employed. It is obvious: the current strife arises from political discord, and not from the terrible economic oppression that fueled the violent uprisings throughout the Middle East over the past few years.

- However, recent events make Turkey’s economic situation precarious. The linchpin is the local currency, the lira.

- Turkey incurs a substantial trade deficit, and is dependent on foreign funding to plug the gap. The current unrest and resulting political fallout may shake investors’ confidence in the lira; and as the lira falls, Turkey’s cost of borrowing from abroad could become punitive – an “Achilles heel” for the economy.

- Turkey has done little to reduce the absolute extent to which it relies on foreign funding, but it has improved the quality and stability of its borrowing, thereby reducing the risk of a liquidity crisis.

- On the plus side, I saw plenty of evidence that, across several industries, Turkish businesses are beginning to act as the “lead dog” within the surrounding region. To date, the country has benefited from its position as a stable democracy, in a region that is notoriously unstable. The current protests obviously undermine that position, with uncertain consequences.

It is difficult for me to express my surprise at recent events in Istanbul. I visited the city approximately three weeks before the protest movement in Taksim unfolded, and I stayed only three blocks away from the square. Though I did not happen to visit Gezi Park – the epicenter of the protest movement – I did walk nearly everywhere else nearby, and I saw few signs that an eruption of mass protest would soon follow. I saw many young people in the streets, but most all looked well fed, carefree and employed. I left the city at about 3:30 AM on a Saturday; the streets around Taksim were strikingly full of happy revelers, slowly making their way home after a night on the town.

I did have a few brief conversations with residents of Istanbul who remarked on Prime Minister Erdogan’s increasingly authoritarian style; and a few others hinted at discontent with Erdogan’s obscure linkages to the Gulen movement.1 However, I have had such conversations before, and I largely dismissed them as mild discontent among Istanbul’s professional, urban elite. I did not think this discontent would spill over to the streets.

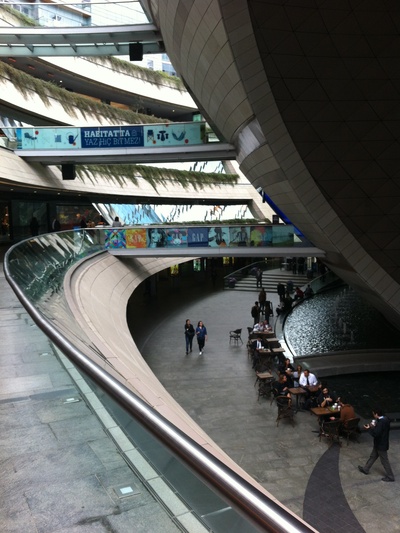

What I did see all over was graffiti. Most of it was interesting, and very artistic; you can see a few photos posted on this page. However, the astonishing volume made me wonder what the real message was. Though none of the graffiti was explicitly protest-oriented, it was prolific enough to make me think all was not well in Istanbul. Three weeks later, the carefree young people I saw spilling out of bars were marching frustrated in the streets.

Against this volatile backdrop, the economy seemed (mostly) in good shape. When I visited Turkey one year ago, I noted the economy seemed poised “precariously between growth and contraction.” In hindsight, the economy did quite well, expanding by 2% last year. I think that’s none too shabby given the surrounding headwinds: the Eurozone’s lethargy (the EU is Turkey’s largest trading partner), conflict in Syria, and instability throughout the Middle East.2 Based on what I could observe in the streets of Istanbul – anecdotal evidence, admittedly – the economy is in fine health.

My prior notes also remarked (obscurely) that the central bank needed “agility and luck if it is to steer Turkey through … a tricky economic landscape.” I was referring obliquely to the fact that Turkey was then running a substantial trade deficit, and that its banking system was heavily reliant on funding from foreign sources to cover some of the resulting financial gap. I was concerned that, despite the clever and practical efforts of the country’s central bank, there was a real risk that Turkey would face some sort of liquidity shock, and that the local currency, the lira, would plummet under excessive financial strain.

Jumping forward to the present date, not much has changed – at least at first glance. Turkey still runs a very large trade deficit (the biggest bill arises from the carbon energy that it imports); and its financial system is still highly dependent on foreign sources of capital.3 There has been one notable development, though: the quality of the foreign borrowing is beginning to improve. Last year, Turkey’s banks were borrowing loads of Euro at cheap rates, but with very short-term maturities. That was a risky business: the short-term maturities meant that foreign creditors could pull their funding on short notice, or they could make sudden and draconian revisions to the interest rates they charged, thereby exacerbating (or even precipitating) a financial crisis. Now, Turkish banks enjoy access to capital markets on much improved terms. They are issuing bonds with longer maturities, typically in excess of five years, and they are locking in lower rates of interest when they do so. Unfortunately, this enhanced access to long-term credit markets still exposes the banks to substantial currency risks, but at least the risk of a short-term funding shock is rapidly abating. Moody’s has recently recognized Turkey’s improved position by upgrading its rating on the country’s sovereign bonds to Baa3, its lowest-level investment grade rating.

Lastly, I noted previously that I saw signs that Turkish businesses “consistently exhibit the skill and flexibility to exploit formative markets in surrounding countries.” By that I meant that Turkish companies seemed skillful in their expansion into the smaller and less-well organized (sometimes chaotic) economies of neighbor states. On this trip I saw more of the same: it seems to me that across several industries, Turkish businesses are beginning to act as the “lead dog” within the surrounding region. Turkey has gained from being the strong, stable country in a notoriously volatile neighborhood, and that’s a good thing: Singapore and China have taken up similar leadership roles in ASEAN and East Asia, respectively, and each has benefitted. However, the protests in Gezi Park undermine the perception of strength – and no one knows what will happen next. We will watch events there carefully.

Andrew FosterIstanbul

- The views and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writer's current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. Seafarer does not accept any liability for losses either direct or consequential caused by the use of this information.

- The New Yorker, “The Deep State,” 12 March 2012.

- Gros and Selçuki, “The Changing Structure of Turkey’s Trade and Industrial Competitiveness: Implications for the EU,” January 2013, pg 7.

- Turkish Statistical Institute.

![[Chrome]](/_layout/images/ua/chrome.png)

![[Firefox]](/_layout/images/ua/firefox.png)

![[Opera]](/_layout/images/ua/opera.png)

![[Microsoft Edge]](/_layout/images/ua/edge.png)