- Among the seven emirates that form the United Arab Emirates (UAE), Abu Dhabi and Dubai are distinguished by their modern infrastructure and architecturally remarkable skyscrapers, as well as their increasingly open business climates.

- Recently announced initiatives to open up certain sectors of the economy to full foreign ownership are one indication that that the UAE is serious about its intention to reduce its dependency on oil revenues.

- The UAE is the financial and business hub for the Middle East, but it is also home to a handful of interesting transportation, logistics and services companies – some of which are deftly expanding into neighboring regions.

Sultan Bin Saeed Al Mansouri, the UAE’s Minister of the Economy, made headlines earlier this year with the announcement of plans to allow full foreign ownership of businesses in some sectors of the economy through the introduction of a law to encourage foreign direct investment (FDI), innovation and technology transfer. This law has been a long time in the making and is still not finalized, but I am encouraged by this announcement, as an open financial market is arguably the most important pillar of economic development. Structural reforms like this will facilitate the Emirati goal of diversifying the economy and reducing dependence on oil revenues to below 10% of gross domestic product (GDP).

Mr. Al Mansouri has also articulated the goal of having the UAE rank amongst the top 10 countries in the World Bank’s “Ease of Doing Business Index.”1 The UAE was ranked number 31 in this index in 2016, and from what I experienced on my recent investment trip to the region, the UAE is solidly on track to improve its ranking.2 The process of setting up meetings with companies in both Dubai and Abu Dhabi was quite easy compared to what I have experienced in other countries and the quality of these meetings was remarkably high in terms of information disclosed and insights shared.

Despite having an increasingly open business climate, the UAE’s financial markets are quite concentrated. As of November 2015, there were 118 listed companies in the UAE that together had a combined market capitalization of just over US$200 billion. While the aggregate market capitalization of listed companies in the UAE is similar in size to that of listed companies in Finland, Chile, or the Philippines, the UAE is a highly concentrated market with the largest 10 companies constituting fully $136 billion (or 67%) of this total combined market capitalization.3 Not surprisingly, these 10 largest companies include the national telecommunications companies as well as the large banks and property developers in the region (the oil enterprises in the region are mostly state owned and are not publicly listed).

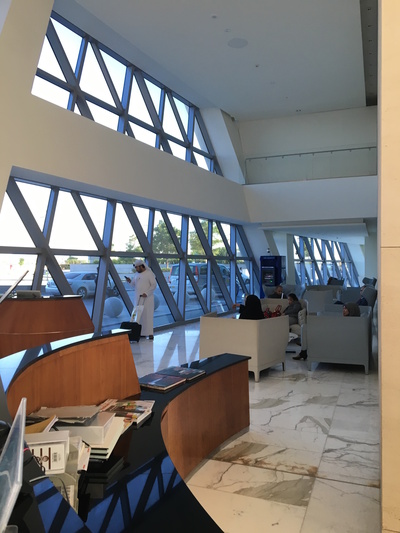

Although the economy is heavily dominated by the oil, telecommunications, bank and property sectors, there are a few logistics and services companies in the UAE worthy of note. Companies that operate in the services industries hold special allure to me as an investor for the reasons that they tend to have little or no state involvement, their success is often attributable to the indefatigable entrepreneurial approach of the founders, and more often than not these companies have a willingness to expand into other regions. I visited one such logistics company on my recent trip to the UAE and was greatly impressed by the quality of its warehouse facilities, diverse customer base and overseas expansion plans.

While the UAE is an impressive, young market with some important government-led directives to increase foreign direct investment and promote an open business climate, there are several considerations of which to be aware before investing in the region. For instance, there is no bankruptcy law in the UAE, though a draft law on financial regulation and bankruptcy has long been underway. Another issue is the rapid growth of the property sector. The vast majority of property developments in both Dubai and Abu Dhabi has been constructed quite recently, so in light of today’s low price of oil, it is not surprising that there is a great deal of investor concern surrounding Emirati property prices as well as bank asset quality in the region. These are issues that investors will need to watch carefully as they play out. In the meantime, the small but growing services and logistics industry in the UAE is one to pay attention to, especially as it expands overseas.

Kate Jaquet

- The views and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writer's current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. Seafarer does not accept any liability for losses either direct or consequential caused by the use of this information.

- Kate Jaquet is a Registered Representative of ALPS Distributors, Inc.

- The World Bank Group Ease of Doing Business index ranks global economies based on objective measures of local business regulations and their enforcement. As of 2016, the index ranks economies from 1 to 189, with first place being the best. A high ranking (a low numerical rank) means that the regulatory environment is conducive to business operation.

- Source: The World Bank Group, “Ease of Doing Business in United Arab Emirates,” 2016.

- Source: Bloomberg, November 2015.

![[Chrome]](/_layout/images/ua/chrome.png)

![[Firefox]](/_layout/images/ua/firefox.png)

![[Opera]](/_layout/images/ua/opera.png)

![[Microsoft Edge]](/_layout/images/ua/edge.png)