Seafarer Announces Appointment of Paul Espinosa as Co-Chief Investment Officer

– Paul Espinosa was named Co-Chief Investment Officer (Co-CIO) of Seafarer Capital Partners, the adviser to the Seafarer Funds. Andrew Foster, the CIO of the Firm since its founding in 2011, will remain in the role, serving as Co-CIO alongside Paul.

News ReleaseChina Leadership Monitor – The Economic Costs of China’s Self-Sufficiency Drive

– In an article for China Leadership Monitor, Nicholas Borst explains that China’s drive for economic self-reliance comes with significant tradeoffs and, ironically, may provoke some of the risks it seeks to avoid. : As of June 30, 2025, securities mentioned in this commentary comprised the following weights in the Seafarer Overseas Growth and Income Fund: Samsung Electronics, Co., Ltd. (3.5%), and Samsung Electronics Co., Ltd. Pfd. (0.9%). As of June 30, 2025, the Seafarer Funds did not own shares in the other securities referenced in this commentary. View the Seafarer Overseas Growth and Income Fund’s Top 10 Holdings. Holdings are subject to change.

MoreThe Wire China – Interview with Nicholas Borst

– In an interview with The Wire China, Seafarer’s Nicholas Borst discusses Beijing’s approach to managing its economy: utilizing private markets while maintaining state control.

MoreMoney Life – Interview with Andrew Foster

– In an interview with Money Life’s Chuck Jaffe, Andrew Foster reports on the growing earnings and strengthening currencies in emerging markets. He discusses the importance of gaining exposure to non-U.S. dollar sources of return, including diversified streams of investment income. Listen

MoreAmerica First Investment Policy: What it Means for U.S.-China Relations

– In an interview with the National Committee on U.S.-China Relations, Nicholas Borst discusses the implications of the U.S. administration’s new America First Investment Policy for U.S.-China economic and trade relations.

America First Investment Policy: What it Means for U.S.-China RelationsSeafarer Reveals Key Drivers of Performance in Emerging Markets Value Investing

– Seafarer published a white paper that examines the practical lessons Seafarer’s Value team has learned in its pursuit of seven distinct sources of value in the emerging markets.

News ReleaseThe Wire China – Under Pressure: Why China is Pledging More Capital for its Banks

– In The Wire China, Seafarer’s Nicholas Borst writes that Beijing’s pledge to recapitalize large banks is intended to prevent growing pressures within the financial system from escalating to a crisis. : As of September 30, 2024, the Seafarer Funds did not own shares in the securities referenced in the article. View the Top 10 Holdings for the Growth and Income Fund and the Value Fund. Holdings are subject to change.

MoreMoney Life – Interview with Andrew Foster

– In an interview with Money Life’s Chuck Jaffe, Andrew Foster discusses the broad-based EM earnings recovery underway and how overseas markets can help diversify long-term portfolios with non-dollar income streams. Listen

MoreOMFIF – How Deeply Rooted Are China’s Economic Woes?

– In OMFIF, Seafarer’s Nicholas Borst writes that China’s slowdown can be traced to four major problems: a real estate correction, weak consumption, deteriorating local government finances, and a constrained private sector.

MoreThe Wire China – The Financial Fallout from China’s Property Market

– In The Wire China, Seafarer’s Nicholas Borst writes that China’s economic recovery will continue to disappoint unless urgent reforms are enacted to revive the property market and restructure local government debt. : As of December 31, 2023, the Seafarer Funds did not own shares in the securities referenced in the article. View the Top 10 Holdings for the Growth and Income Fund and the Value Fund. Holdings are subject to change.

MoreAfter the Boom: What China’s Slowing Economy Means for Global Markets

– Nicholas Borst moderated a panel that examined how China’s new economic trajectory will impact global markets and the potential implications for investors.

After the Boom: What China’s Slowing Economy Means for Global MarketsConsuelo Mack WealthTrack – Interview with Andrew Foster

– In an interview with Consuelo Mack, Andrew Foster states that the investment case for emerging markets lies in individual companies rather than countries.

MoreValue Investor Insight – Bottoms Up

– In an interview with Value Investor Insight, Paul Espinosa discusses Anheuser-Busch InBev’s improved performance in non-U.S. markets and ongoing efforts to deleverage its balance sheet.

Value Investor InsightMoney Life – Interview with Andrew Foster

– In an interview with Money Life’s Chuck Jaffe, Andrew Foster discusses how some EM companies are transforming from government-owned entities to private sector enterprises, and reaping productivity gains in the process, while others are reshaping entire industries. Listen

MoreMutual Fund Observer – In Conversation with Andrew Foster

– In an interview with Mutual Fund Observer, Andrew Foster explains why he expects the biggest fundamental change in EM stocks to come through stock buybacks. : As of September 30, 2023, the Seafarer Funds did not own shares in the securities referenced in the article. View the Top 10 Holdings for the Growth and Income Fund and the Value Fund. Holdings are subject to change.

MoreU.S.-China Commission – China’s Economy: Implications for Investors

– In testimony to the U.S.-China Economic and Security Review Commission, Nicholas Borst discusses the causes of China’s economic slowdown and the risks of local government debt.

Testimony – China’s Current EconomyValue Investor Insight – Roads Less Traveled

– In an interview with Value Investor Insight, Andrew Foster explains that he searches for companies that can grow with sustainable profitability, and whose stocks are cheap enough to make them relatively immune to economic and cyclical risks.

Value Investor Insight InterviewMutual Fund Observer – Seafarer Overseas Value Fund

– In Mutual Fund Observer’s profile of the Value Fund, Paul Espinosa describes EM corporates that are expanding internationally, led by management teams with experience in navigating challenging market conditions. : As of March 31, 2023, Samsung Biologics Co., Ltd. comprised 4.3% of the Seafarer Overseas Growth and Income Fund, Samsung Electronics Co., Ltd., Pfd. comprised 3.5% of the Fund, Samsung SDI Co., Ltd. comprised 2.6% of the Fund, Samsung C&T Corp. comprised 1.4% of the Fund, Samsung Electronics, Co., Ltd. comprised 1.4% of the Fund, WH Group, Ltd. comprised 1.3% of the Fund, Ambev SA comprised 2.1% of the Fund, Anheuser-Busch InBev SA comprised 2.2% of the Fund, and DFI Retail Group Holdings, Ltd. comprised 1.4% of the Fund. As of March 31, 2023, Samsung SDI Co., Ltd. comprised 3.1% of the Seafarer Overseas Value Fund, Samsung C&T Corp. comprised 2.0% of the Fund, Samsung C&T Corp., Pfd. comprised 0.2% of the Fund, WH Group, Ltd. comprised 2.7% of the Fund, Ambev SA comprised 2.3% of the Fund, Anheuser-Busch InBev SA comprised 2.8% of the Fund, Melco International Development, Ltd. comprised 3.5% of the Fund, Shangri-La Asia, Ltd. comprised 3.3% of the Fund, and DFI Retail Group Holdings, Ltd. comprised 2.4% of the Fund. View the Top 10 Holdings for the Growth and Income Fund and the Value Fund. As of March 31, 2023, the Seafarer Funds did not own shares in the other securities referenced in this commentary. Holdings are subject to change.

MoreCSIS ChinaPower Podcast – Interview with Nicholas Borst

– In an interview with the CSIS ChinaPower Podcast, Nicholas Borst discusses how growing debt levels in China – concentrated among local governments, real estate developers, and state-owned enterprises – stem from an imbalanced fiscal system, and why they are a source of financial risk. Listen

MoreChina Leadership Monitor – China’s Balance Sheet Challenge

– In an article for China Leadership Monitor, Nicholas Borst examines the scale of China’s debt problem and how policymakers can put the country’s balance sheet on firmer footing. : As of December 31, 2022, Alibaba Group Holding, Ltd. comprised 3.9% of the Seafarer Overseas Growth and Income Fund. View the Seafarer Overseas Growth and Income Fund’s Top 10 Holdings. As of December 31, 2022, the Seafarer Funds did not own shares in the other securities referenced in this commentary. Holdings are subject to change.

China’s Balance Sheet ChallengeCFA Society San Francisco – Interview with Nicholas Borst

– In an interview with CFA Society San Francisco, Nicholas Borst explains that amid increasing state control over China’s economy and tense U.S.-China relations, there are four underappreciated developments in Chinese companies and corporate governance. Listen

MoreValue Investor Insight – Shifting Fortunes?

– In an interview with Value Investor Insight, Paul Espinosa discusses Value Fund holdings to illustrate how the Fund identifies companies that are undervalued or poised to be more productive.

Value Investor Insight InterviewOMFIF – Brazil is Undergoing a Fintech Revolution

– In OMFIF, Seafarer’s Kate Jaquet writes that Brazil is well suited to fintech innovations due to the rigidity of its traditional banks, shifting consumer preferences, and pivotal government initiatives.

MoreMoney Life – Interview with Paul Espinosa

– In an interview with Money Life’s Chuck Jaffe, Paul Espinosa explains that the Value Fund pursues total return driven by companies with distinct sources of return that are diversified from the overall market. Listen

MoreU.S.-China Economic Conflict: Implications for Investors and the Business Community

– Nicholas Borst moderated a panel that examined what the strained relationship between the world’s two largest economies means for investors and businesses.

Risks and Opportunities: The U.S.-China Financial RelationshipOMFIF – China’s Economic Recovery is Balance Sheet Constrained

– In OMFIF, Seafarer’s Nicholas Borst writes that Beijing can no longer spare its own balance sheet if it wants to both stimulate the economy and keep local governments solvent. : As of September 30, 2022, the Seafarer Funds did not own shares in the entities referenced in the article. View the Top 10 Holdings for the Growth and Income Fund and the Value Fund. Holdings are subject to change.

MoreLydia So Added as a Lead Manager of Growth and Income Fund

– Lydia So was named a Lead Portfolio Manager of the Seafarer Overseas Growth and Income Fund. She joins Andrew Foster and Paul Espinosa, who remain Lead Portfolio Managers of the Fund.

News ReleaseThe Diplomat – China’s Interventionist Approach to Managing Financial Risks

– In The Diplomat, Seafarer’s Nicholas Borst writes that China’s new approach to cleaning up the financial sector is likely to result in a more state-centric economy. : As of June 30, 2022, the Seafarer Funds did not own shares in the entities referenced in the article. View the Top 10 Holdings for the Growth and Income Fund and the Value Fund. Holdings are subject to change.

MoreToday On Wall St. – Is Evergrande China’s Lehman Moment?

– In an interview with Today On Wall St., Seafarer’s Nicholas Borst explains why discussion of a “Lehman Moment” in China overlooks the fact that the country’s property sector is grappling with problems distinct from those the U.S. faced in 2008. : As of March 31, 2022, the Seafarer Funds did not own shares in the entities referenced in the video. View the Top 10 Holdings for the Growth and Income Fund and the Value Fund. Holdings are subject to change.

MoreThe Wire China – Understanding China’s Household Balance Sheet

– In The Wire China, Seafarer’s Nicholas Borst writes that China’s household balance sheet is stronger than commonly thought, but its strength depends on residential housing prices remaining high.

MoreMoney Life – Interview with Andrew Foster

– In an interview with Money Life’s Chuck Jaffe, Andrew Foster notes that emerging markets can offer a source of diversified growth within an investor’s portfolio – but given the volatility of the asset class, a long-term time horizon is essential. Listen

MoreMoney Life – Interview with Paul Espinosa

– In an interview with Money Life’s Chuck Jaffe, Paul Espinosa explains that the past ten years may have been a lost decade for emerging market investors, but not for EM corporates, which accumulated retained earnings and grew dividends. : As of December 31, 2021, Ambev SA comprised 2.7% of the Seafarer Overseas Growth and Income Fund and 3.4% of the Seafarer Overseas Value Fund. View the Top 10 Holdings for the Growth and Income Fund and the Value Fund. Holdings are subject to change. Listen

MoreAsia Society Conference – Risks and Opportunities: The U.S.-China Financial Relationship

– In an Asia Society Conference panel, Nicholas Borst explains why the U.S. and China share responsibility for the current state of the deteriorating bilateral investment relationship.

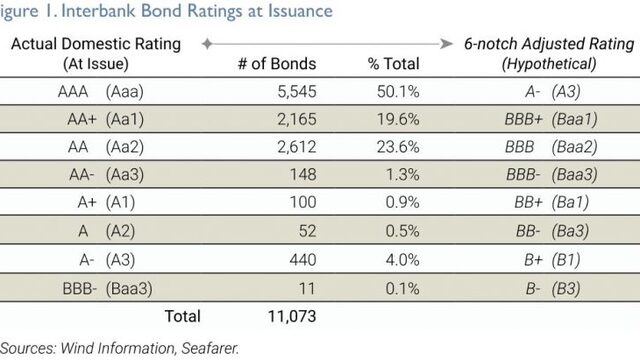

Risks and Opportunities: The U.S.-China Financial RelationshipThe Diplomat – The Idiosyncrasies of China’s Bond Market

– In The Diplomat, Seafarer’s Kate Jaquet writes that China’s bond market appears hampered by unpredictable default mechanisms, non-standardized bond covenants, and unreliable bond ratings.

MoreMoney Life – Interview with Andrew Foster

– In an interview with Money Life’s Chuck Jaffe, Andrew Foster explains that innovative, globally competitive companies are emerging from the developing world, despite slowing economic growth. Listen

MoreAdvisorpedia – Understanding the Trade-offs in Emerging Markets Indices

– In Advisorpedia, Seafarer’s Steph Gan writes that as leading emerging market indices pursue scalability and replicability, they favor large-capitalization companies and are overweight several scale-dependent sectors. : As of March 31, 2021, Samsung Electronics Co., Ltd. comprised 4.5% of the Seafarer Overseas Growth and Income Fund and Ping An Insurance Group Co. of China, Ltd. comprised 3.6% of the Fund. The Seafarer Funds did not own shares in the other entities referenced in this commentary. View the Top 10 Holdings for the Growth and Income Fund and the Value Fund. Holdings are subject to change.

MoreThe Wire China – The Party on the Inside: The CCP and Chinese Companies

– In The Wire China, Seafarer’s Nicholas Borst writes that China’s effort to entrench the Chinese Communist Party within companies is incompatible with its desire to be treated as a modern market-based economy.

MoreThe Interpreter – Has China Given Up On SOE Reform?

– In the Lowy Institute’s The Interpreter, Seafarer’s Nicholas Borst discusses why the lack of transparency around Chinese state-owned enterprises has contributed to growing levels of distrust, both within and outside of China, about the government’s intentions.

MoreMoney Life – Interview with Andrew Foster

– In an interview with Money Life’s Chuck Jaffe, Andrew Foster compares three countries that dominate EM – China, Taiwan, and South Korea – with other EM countries in terms of valuations and the path to pandemic-related “normalization.” He also discusses China’s evolving role within the EM asset class. Listen

MoreAsia Society Conference – Rebalancing the U.S.-China Economic Relationship

– In an Asia Society Conference panel, Nicholas Borst explains how the increase in holdings of Chinese securities by U.S. investors has emerged as a major source of conflict in the U.S.-China economic relationship.

Rebalancing the U.S.-China Economic RelationshipU.S.-China Commission – 2020 Report to Congress

– The U.S.-China Economic and Security Review Commission's 2020 Report to Congress quotes Nicholas Borst on China’s stock markets and cites The Evolution of China’s Bond Market by Kate Jaquet.

U.S.-China Commission – 2020 Report to CongressMoney Life – Interview with Andrew Foster

– In an interview with Money Life’s Chuck Jaffe, Andrew Foster discusses three factors shaping the outlook for EM countries amid the Covid-19 pandemic: preparedness of healthcare and emergency response systems; deployment of monetary stimulus from central banks; and the presence of companies with resilient balance sheets, strong industrial capacities, and customer demand. Listen.

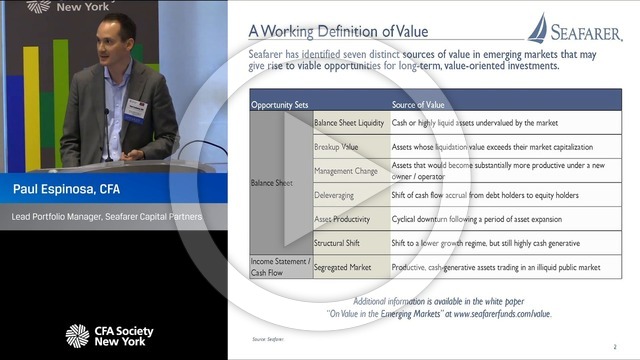

MoreValue Investor Insight – Sources of Value

– In an interview with Value Investor Insight, Paul Espinosa uses Seafarer’s framework of seven sources of value to explain his investment approach and discuss several Fund holdings. Andrew Foster asserts that structural conditions in the emerging markets have changed such that a value strategy can be realized.

Value Investor Insight InterviewMutual Fund Observer – Emerging Market Value Investing Revisited

– Mutual Fund Observer’s David Snowball provides an update on the long-term case for emerging market value investing. He highlights the Seafarer Overseas Value Fund in an analytical comparison of emerging market value funds.

MoreBloomberg – Emerging Market Stock Picker Says Key Is Ignoring Macro “Noise”

– In an interview with Bloomberg, Paul Espinosa explains that he approaches stock selection by tuning out the macro “noise” and focusing on stock-specific research. Paul notes that he examines value stocks in terms of the drivers that produce cash flows, instead of merely weighing the valuation multiples.

MoreMoney Life – Interview with Andrew Foster

– In an interview with Money Life’s Chuck Jaffe, Andrew Foster asserts that while growth in emerging market countries is slowing, the markets are still producing great companies. Increasingly, world-class companies are emerging from these markets. Listen.

MoreBen Graham Conference – Value in Emerging Markets Panel

– At the Ben Graham VI Annual Conference hosted by CFA Society New York, Paul Espinosa applies Seafarer’s seven distinct sources of value to the securities universe within the emerging markets and concludes that the opportunity for value-oriented investments is significant.

MoreThe Diplomat – Understanding China’s Bond Ratings

– In The Diplomat, Seafarer’s Kate Jaquet writes that the arrival of international credit rating agencies in China could draw greater foreign participation to the Chinese bond market.

MoreU.S.-China Commission – What Keeps Xi Up at Night

– In testimony to the U.S.-China Economic and Security Review Commission, Nicholas Borst describes the array of challenges facing the Chinese economy and the structural reforms that would help China achieve sustainable economic growth.

Looking Back on China’s 2018Money Life – Interview with Andrew Foster

– In an interview with Money Life’s Chuck Jaffe, Andrew Foster explains three reasons for an improved outlook in emerging markets in 2019: reasonable valuations and stable growth, increasing independence from developed markets, and signs of pragmatic leadership in China. Listen.

MoreRe-opening of the Seafarer Overseas Growth and Income Fund

– The Growth and Income Fund’s Institutional Class (SIGIX) will re-open to new investors on November 19, 2018.

MoreMoney Life – Interview with Andrew Foster

– In an interview with Money Life’s Chuck Jaffe, Andrew Foster notes that emerging markets currently exhibit speculative characteristics, led by Chinese shares. Andrew highlights the concentration of the emerging market benchmark index in a handful of Chinese internet stocks. Listen.

MoreConsuelo Mack WealthTrack – Interview with Andrew Foster

– In an interview with Consuelo Mack, Andrew Foster asserts that emerging markets’ new financial independence might allow the asset class to exhibit a meaningful degree of “decoupling” from the developed world.

MoreMoney Life – Interview with Andrew Foster

– In an interview with Money Life’s Chuck Jaffe, Andrew Foster notes that profits in developing markets are growing at a moderate pace, but analysts’ expectations for future growth may be unrealistic. He discusses key risks in these markets, including strained liquidity conditions in China and political instability in Turkey. Listen.

MoreMutual Fund Observer – Elevator Talk: Paul Espinosa, Seafarer Overseas Value

– In Mutual Fund Observer’s “Elevator Talk” segment, Paul Espinosa discusses his approach to value investing in the developing world.

Seafarer Overseas Value Fund ProfileCitywire USA – Interview with Andrew Foster

– In an interview with Citywire USA, Andrew Foster provides an outlook for emerging markets and describes his investment approach.

MoreBarron’s – Emerging Markets Roundtable: Where to Invest Now

– At the Barron’s emerging markets roundtable, Andrew Foster joins three other portfolio managers to discuss the outlook and risks in emerging markets.

MoreMoney Life – Interview with Andrew Foster

– In an interview with Money Life’s Chuck Jaffe, Andrew Foster describes a structural change that has begun to transform the investment landscape within the developing world: the rise of “value.” Andrew suggests that the prerequisites for realizing a “value” strategy in developing markets are materializing, slowly but steadily, with improvements in accounting and legal standards, the proliferation of change-of-control investors, and the development of local currency debt markets. Listen.

MoreLaunch of the Seafarer Overseas Value Fund

– Seafarer launched the Seafarer Overseas Value Fund on May 31, 2016. The Fund applies a value discipline to emerging markets, where Seafarer estimates discounts to intrinsic worth are prevalent and compelling. Though distinct from Seafarer's Growth and Income strategy, the new Value strategy uses the same bottom-up, fundamental research process that is a hallmark of Seafarer’s philosophy. Seafarer believes the Value strategy has the potential to capitalize on long-term, structural changes in the emerging markets.

MoreMoney Life – Interview with Andrew Foster

– In an interview with Money Life’s Chuck Jaffe, Andrew Foster discusses the qualities that distinguish an emerging market. Andrew asserts that emerging markets are, by definition, beset by financial shocks, economic fragility, and governance shortcomings. While such dysfunctions beget unwelcome volatility, they also provide an opportunity to make basic improvements and progress, which can lead to sustainable growth. Listen.

MoreMorningstar – What's Going on in China?

– In an interview with Morningstar, Andrew Foster discusses the causes of recent volatility in the Chinese stock market, and what it means for China’s economy.

Morningstar InterviewValue Investor Insight – Well Traveled

– In an interview with Value Investor Insight, Andrew Foster discusses the Seafarer Overseas Growth and Income Fund’s strategy and holdings, and his approach to value investing in the developing world.

Value Investor Insight InterviewMutual Fund Observer – Seafarer Overseas Growth and Income Fund Profile

– The Mutual Fund Observer offers its analysis and views of the Seafarer Overseas Growth and Income Fund.

Seafarer Overseas Growth and Income Fund ProfileConsuelo Mack WealthTrack – Interview with Andrew Foster

– In an interview with Consuelo Mack, Andrew Foster describes what he looks for in an investment: sustainable growth and current income. He discusses how China’s growth model is changing, and how service sectors are likely to lead the way. He offers thoughts on Turkey’s potential, and he expresses confidence that growth persists despite severe global challenges.

MoreBloomberg – A Fund For The Risk-Averse In Emerging Markets

– In an interview with Bloomberg, Andrew Foster discusses Seafarer’s investment strategy and the opportunities he sees in emerging markets.

InterviewInvesting Daily – Emerging Market Stocks: The BRIC Is Just the Beginning

– In an interview with Investing Daily, Andrew Foster addresses the economic transition taking place in some emerging markets and the investment opportunities arising from this shift.

InterviewMutual Fund Observer – Interview with Andrew Foster

– In an interview with David Snowball, Andrew Foster discusses why he founded Seafarer and the characteristics that distinguish Seafarer Overseas Growth and Income Fund.

InterviewSeafarer Overseas Growth and Income Fund Launched

– The primary investment objective of this new, no-load fund is to provide investors with long-term capital appreciation along with some current income. As a secondary objective, the Fund seeks to mitigate adverse volatility in returns.

News Release- The views and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect Seafarer's current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. Seafarer does not accept any liability for losses either direct or consequential caused by the use of this information.

- For an explanation of terms, please refer to our glossary.

- View the Seafarer Overseas Growth and Income Fund’s Top 10 Holdings. View the Seafarer Overseas Value Fund’s Top 10 Holdings. Holdings are subject to change.

- View the Funds’ most recent month-end performance. Past performance does not guarantee future results. It is not possible to invest directly in an index.

![[Chrome]](/_layout/images/ua/chrome.png)

![[Firefox]](/_layout/images/ua/firefox.png)

![[Opera]](/_layout/images/ua/opera.png)

![[Microsoft Edge]](/_layout/images/ua/edge.png)