- China has engaged in three major economic stimuluses over the past 15 years. Each program shrunk the fiscal space available to respond to the next crisis.

- The central government is reluctant to incur large amounts of debt directly and instead uses local governments and off-balance sheet borrowing.

- China’s approach to stimulus is running out of steam. Beijing must choose between preserving its own balance sheets and keeping local governments financially solvent.

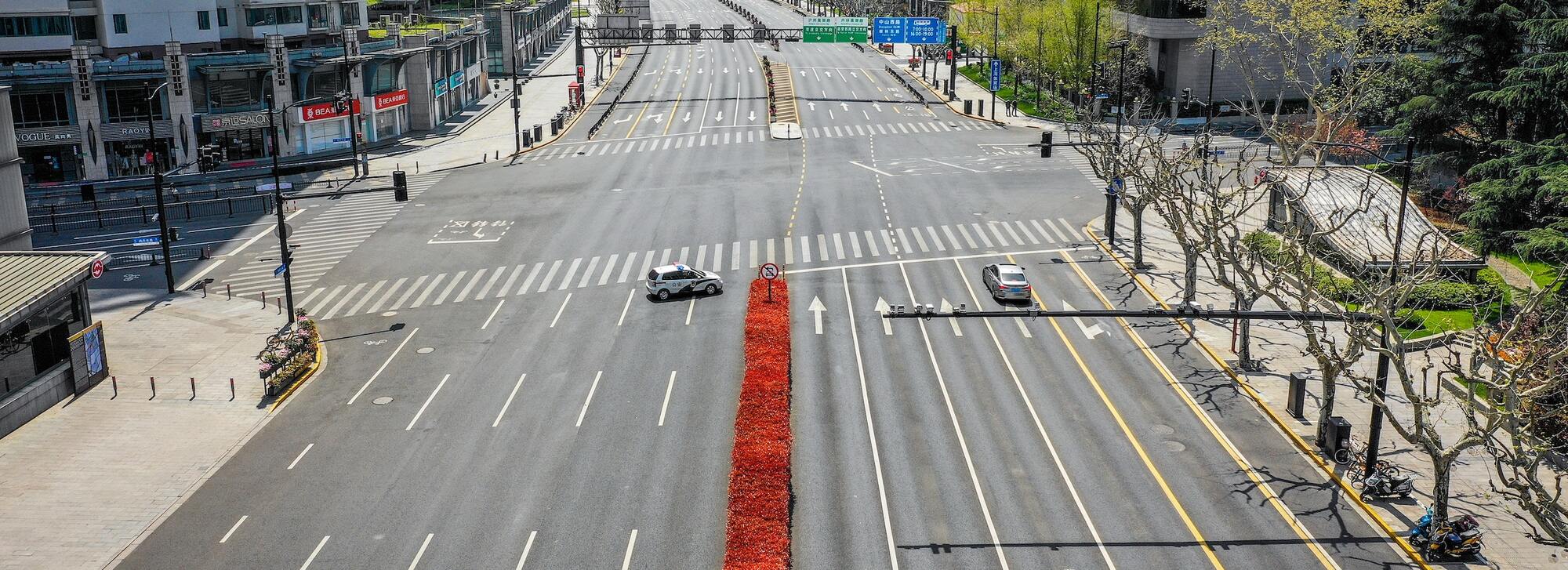

Covid lockdowns, weak consumer demand, and brittle private sector confidence are causing major disruptions to the Chinese economy. Headline growth has slowed to a crawl and the economic reality may be even worse than what official statistics indicate. In the face of such a challenging environment, many observers have wondered why the Chinese government has not done more to stimulate the economy.

Prevailing Winds is a China-focused blog written by Nicholas Borst, Director of China Research at Seafarer. The blog tracks the economic and financial developments shaping the world’s largest emerging market.

It’s not that Chinese policymakers have done nothing: over the past several weeks, the government has announced 33 new policy measures to stabilize the economy, including business tax rebates, infrastructure investment, support for lending to small businesses, and targeted consumption incentives.1 But although the number of new stimulus measures announced is significant, the measures themselves are largely incremental. And taken together, they represent only a marginal increase in spending relative to 2021, leaving spending significantly below 2020 levels.2 Officials are now discussing pulling forward planned spending from 2023, but the amount of new demand this will create is uncertain.

The response seems wholly insufficient given the scale of the current economic challenge. Recent statements by Premier Li Keqiang confirm that some in China’s leadership view the economic situation as potentially worse than in 2020.3 This assessment is correct: China’s current situation is indeed more precarious than it was then. The real estate sector is weaker, the financial system is facing more severe risks, and the growth and dynamism of the private sector have been significantly damaged.

The modest scale of China’s current stimulus – and the muted market reaction to it – contrast sharply with past efforts. During the depths of the 2008 global financial crisis, for example, Chinese policymakers announced a massive economic stimulus. The announcement buoyed markets and was credited with providing the global economy with a much-needed boost at a time when global demand was faltering.

Given the current economic risks, then, why has China’s stimulus been so underwhelming? The answer involves the balance sheet constraints of the Chinese government and the ways in which they limit the scope of possible policy responses.

How Has China Responded to Economic Crises?

China has provided three major economic stimuluses over the past 15 years. Each program shrunk the fiscal space available to respond to the next crisis.

Response to the Global Financial Crisis in 2008–2010

China’s leadership was extremely concerned about the impact of the global financial crisis, which caused a precipitous collapse in global demand and large job losses in export industries in China. To help offset the effects of the crisis, policymakers announced a massive stimulus program that included 4 trillion Renminbi (RMB) in spending, focused primarily on infrastructure.4 Of the 4 trillion RMB in announced spending, the central government committed to financing only 1.22 trillion – just 30%.5 The remainder fell upon local governments, banks, and state-owned enterprises (SOEs).

Local governments faced a dilemma. They were tasked with implementing the stimulus spending but were legally prohibited from directly issuing their own debt. To overcome this obstacle, they turned to off-balance sheet shell companies called local government financing vehicles (LGFVs) to finance their spending.6 The central government tacitly blessed this workaround, given the exigencies of the situation.

Financial regulatory standards were also loosened, as the government pressured banks to lend freely. This move led to a massive increase in debt, with the total stock of credit in the Chinese economy more than doubling between the end of 2008 and the end of 2011, as shown in Figure 1. LGFVs emerged as one of the largest borrowers from banks during this period.7 Through them, local governments would ultimately end up borrowing much more than the 3 trillion RMB in stimulus spending they were tasked with in 2008. Indeed, by the end of 2012, the stock of LGFV debt was estimated to exceed 9 trillion RMB.8

- Source: Bank for International Settlements.9

In later years, this approach would be characterized as a “flood-like” stimulus. The ramp-up in local government spending and the increase in credit across the economy was successful in stabilizing growth. In fact, in the years immediately after the stimulus, many economists worried about China’s economy overheating. The approach also created a massive debt hangover, however, with local governments and many industries struggling to work through a mountain of bad loans in the years following the stimulus.

Response to the Housing Slowdown and Stock Market Decline in 2015–2017

China’s economy faced a perilous situation again in 2015. The previous year, the housing market – one of the drivers of economic growth – had begun to slow. The media was full of stories about China’s ghost cities, and some analysts estimated that China had tens of millions of empty apartments.10 Given excess inventory and falling demand, the housing market – and the industries linked to it – were expecting a potentially steep decline.

The economic situation deteriorated in the summer of 2015. After a speculative run-up in prices, the Chinese stock market plummeted. The government organized large bailout funds (the so-called national team) to support the stock market, but the effort failed to stem the decline and equity prices continued to fall into 2016. By January 2016, the Shanghai Composite Index had lost almost half its value relative to the high the previous July.11

In August, a change to China’s exchange rate management regime spooked markets, causing money to leave the country and putting pressure on the yuan. Between 2015 and 2016, China experienced more than 1 trillion USD in capital outflows.12 To prevent a currency crisis, it was forced to implement new capital account restrictions and burn through hundreds of billions of dollars of foreign exchange reserves.

To revive the economy, the government increased spending via a variety of programs. One was a massive slum redevelopment campaign, financed by the China Development Bank, under which local governments tore down millions of old and substandard housing units and built new developments.13 The program provided much-needed support for the real estate market by generating new demand for housing units and soaking up excess inventory.

Chinese policymakers also ramped up spending on programs like the Belt and Road Initiative and Made in China 2025. As in 2008, the central government directly financed very little of the spending. Local governments, LGFVs, policy banks, and government funds were responsible for the bulk of stimulus expenditures; the central government was responsible for only a small fraction of the government debt incurred during this period, as shown in Figure 2.

- Sources: International Monetary Fund, CEIC, Seafarer.14

With heavy stimulus spending, the Chinese economy stabilized. However, unlike in 2008, there was no sharp rebound in growth. The growth trend line continued to decelerate, indicating that this approach to economic stimulus was not as effective as it had been. The credit intensity of growth – a measure of how much new credit is required to produce additional economic growth – had deteriorated significantly: in 2015–2016, three times more credit was required per unit of economic growth than in 2007–2008.15

This stimulus occurred during a sensitive political period, during which political considerations undoubtedly influenced the scale and scope of spending. In 2017, Xi Jinping approached his second term as general secretary and sought to eliminate term limits for the presidency. An economy in freefall would have cast significant doubt on his ability to lead the country. Spending lavishly on political pet projects allowed Xi to both stabilize the economy and engage in patronage as he sought to consolidate his hold on power.

Response to the Covid-19 Pandemic in 2020–2021

China faced another major economic challenge in 2020, this time from Covid-19. Much of the country went into hard lockdown, severely disrupting consumption, travel, and manufacturing. In the first quarter of 2020, China reported negative economic growth for the first time in nearly three decades.16

In response to the economic shock from the pandemic, the central government announced a stimulus package. It consisted primarily of direct spending for pandemic-related industries, extension of loan repayment periods for small businesses, a modest easing of credit conditions, and deferral of some social contributions.17 To make modest use of its own budget, Beijing issued 1 trillion RMB worth of special treasury bonds and ran a slightly higher budget deficit. It then transferred the proceeds of the pandemic bonds and the deficit borrowing to local governments to support healthcare spending.18

China’s stimulus package was small by global standards, as shown in Figure 3. As a share of gross domestic product (GDP), for example, the U.S. federal government spent five times as much as China’s central government did.

- Source: International Monetary Fund.19

As before, the bulk of stimulus spending occurred outside the central government’s balance sheet. Beijing permitted local governments to issue trillions of renminbi worth of additional special-purpose bonds, a type of bond used to fund infrastructure that exists in parallel to general local government debt.20 In 2020, for the first time, the total amount of special-purpose debt exceeded general debt.21 In addition, LGFVs continued to incur large amounts of debt off-balance sheet. Borrowing in 2020 by local governments, LGFVs, government funds, and the policy banks was three times higher than that of the central government and equivalent to 10% of GDP, as shown in Figure 4.

- Source: International Monetary Fund.22

The economic recovery in 2021 was far weaker than the recoveries following the two previous crises. Although the economy stabilized, important drivers of growth, such as consumption, have not yet returned to their pre-Covid trendlines. The recovery was so sluggish that President Joe Biden boasted that 2022 would be the first year since 1976 that the U.S. economy would grow more rapidly than China’s.23 Whether that will be the case has yet to be seen. But two years after the Covid stimulus, China’s economy is once again facing a sharp slowdown.

Why Won’t the Central Government Use its Balance Sheet?

The episodes described above reveal an important fact: Even in dire economic situations, China’s central government is unwilling to incur large amounts of debt to directly stimulate the economy. There are two principal reasons why the central government is reluctant to do so. First, the central government guards its balance sheet carefully because of large contingent liabilities. Second, to increase its control, Beijing has created a skewed fiscal system that keeps local governments cash-strapped and dependent on the central government for transfers.

China’s Large Contingent Liabilities

From afar, the balance sheet of China’s central government looks impeccable. China appears to have significantly lower debt levels than major advanced economies and even other emerging markets with similar levels of GDP per capita, as shown in Figure 5.

- Sources: The World Bank, CEIC, Seafarer.

This impression is misleading, however. Lurking behind the central government’s sterling balance sheet lies a vast array of contingent liabilities, including the following:

- Debt issued directly by local governments

- Borrowing by local government financing vehicles

- Government-backed spending funds: special construction funds and government guidance funds

- Debt borrowed by China’s enormous state-owned policy banks (China Development Bank, Export-Import Bank of China, and the Agricultural Development Bank of China)

These other forms of government debt in China are large and growing rapidly, as shown in Figure 6. Taken together, they are nearly five times larger than explicit central government debt.

- Sources: International Monetary Fund, CEIC, Seafarer.24

In addition to these contingent liabilities, other fiscal pressures confronting China’s government are set to increase over the next several decades. For example, the International Monetary Fund (IMF) estimates that China will need to vastly increase pension and healthcare spending to keep pace with an aging society.25

In the face of these large and uncertain obligations, Beijing prioritizes maintaining the strength of its balance sheet. When dealing with economic problems, the overriding objective for the Chinese government is maintaining stability. During a crisis, any (or all) of the borrowers cited above could require a large bailout from the central government.

China’s relative financial stability over the past decade stems in part from the perception of an implicit guarantee of what is otherwise unsustainable debt by these entities. Were the central government to aggressively expand its own balance sheet, its ability to support these other entities might be called into question.

Chinese policymakers have a long memory of the consequences for governments that compromise their financial strength. During the Asian Financial Crisis, China saw many neighboring countries thrown into economic turmoil and forced to request bailouts from the IMF. Zhu Rongji, a key policymaker during that era, was explicit that China would face the very same risks if it allowed its financial strength to deteriorate.26 Beijing’s precautionary approach of preserving its financial strength in the face of unknown risks has been a core tenet of its fiscal management for a quarter century.

China’s Desire to Control Local Governments

On paper, the Chinese government is highly centralized, and Beijing has unchecked authority over the country’s numerous subnational governments. In reality, local governments constantly frustrate Beijing by pursuing their own interests, sometimes in direct conflict with national policy priorities.

The central government uses many mechanisms to control local governments, including personnel appointments, inspections, and oversight by the Chinese Communist Party. Perhaps the most important tool, however, is control over local government budgets.

Local governments are kept relatively cash-strapped by design. Since a major fiscal restructuring in 1994, they have faced a skewed financial position.27 They are responsible for most of China’s government expenditures but receive only a small share of total revenues.

To help offset this shortfall, the central government provides local governments with two sources of revenue. One is extensive subsidies, with which the central government augments local government revenues, as shown in Figure 7. The other is debt issuance – the ability of local governments to issue debt directly since reforms in 2014 – with the amount of debt that can be issued subject to approval by the central government.28

- Sources: Ministry of Finance, CEIC.

This reliance on transfers and debt quotas is designed to maximize the influence of the central government over local governments. By constraining local governments’ ability to issue debt and taking a large share of government revenues for itself, the central government makes local governments reliant on Beijing to fund their budgets. Local governments must request permission to issue more debt or ask for more transfers from the central government, limiting their ability to act in a way contrary to the central government’s interests.

Local governments are not completely dependent on Beijing to plug the holes in their budgets. Sale of land to property developers has emerged as another key source of financing.29 Entrepreneurial local governments seeking to maximize their revenues through lands sales have been one of the driving forces behind China’s real estate boom. However, Beijing has increasingly imposed controls over land sales, in its effort to stamp out speculation in the property market.

The other major channel available to local governments is off-balance sheet borrowing through LGFVs. Historically, this type of borrowing has been prohibited or subject to tight restrictions. However, during times of economic distress, Beijing has selectively allowed local governments to fund stimulus spending through off-balance sheet borrowing. This approach provides the needed economic support without requiring a fundamental shift in the balance of local and central fiscal power.

The problem with this arrangement is that local governments often go overboard, borrowing much more than Beijing thinks is reasonable or sustainable. It has led to an ongoing game of cat and mouse in which local governments find new ways to borrow more while Beijing seeks to shut them down. Periodically, such as in 2015, Beijing has forced local governments to recognize LGFV debt and bring it directly on-balance sheet.

It’s hard to fault local governments for continuously taking on new off-balance sheet debt, given their large unfunded mandates from the central government. Local governments are required to stimulate the economy and support national policies (such as developing a domestic semiconductor industry) while facing structural revenue shortfalls and limitations on their ability to issue debt. As a result, local governments are left no good options other than to muddle their way through and hope they do not displease Beijing.

Stimulus in an Era of Constrained Balance Sheets

China’s approach to stimulus is running out of steam; pushing large amounts of stimulus through local governments is becoming less and less feasible. With debt in excess of 70% of GDP, local governments have become significantly encumbered. They cannot stimulate the economy without taking on more debt – but doing so increases the possibility that local governments, or their affiliated LGFVs, fall into financial distress.

This situation risks making many of Beijing’s implicit liabilities explicit. Being forced to bail out even a modest number of local governments and LGFVs would quickly affect the central government’s own balance sheet. Although Beijing still has a significant amount of fiscal space and faces no immediate limitation on its ability to borrow cheaply, it will no longer be able to maintain its extraordinarily low levels of debt.

The era of fiscal tradeoffs in China has begun. If the economic situation gets bad enough, China may once again be forced to engage in large-scale stimulus. However, another huge run-up in debt would likely put unsustainable financial pressure on many local governments. The central government can no longer spare its own balance sheet if it wants to both stimulate the economy and keep local governments solvent.

Recognition that the current system is approaching its breaking point appears to be growing in Beijing, where reforms to the fiscal transfer system that would better balance revenues and expenditures for local governments are under discussion.30 If these reforms involve a net shift in financial resources to local governments, the central government will run a high budget deficit going forward unless it increases taxes.

The longer-term solution to China’s current dilemma is getting economic growth back on track. First and foremost, China needs to find the right balance between controlling the pandemic and preserving the economy. Second, it needs to reprioritize economic reform. China’s best path forward is to raise the economic growth rate and grow its way out of debt. Doing so will require a recommitment to economic growth – a goal recently usurped by concerns over national security and control.

Nicholas Borst,- As of June 30, 2022, the Seafarer Funds did not own shares in the securities referenced in this commentary.

- The views and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect Seafarer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. Seafarer does not accept any liability for losses either direct or consequential caused by the use of this information.

- “China Issues Policy Package to Stabilize Economy,” State Council of The People’s Republic of China, 31 May 2022.

- “China’s Stimulus Tops $5 Trillion as Covid Zero Hits Economy,” Bloomberg, 19 May 2022.

- Lily Kuo, “‘No Time to Lose’: Top Chinese Official Sounds Alarm over Economy,” The Washington Post, 26 May 2022.

- Zhuo Chen, Zhiguo He, Chun Liu, “The Financing of Local Government in China: Stimulus Loan Wanes and Shadow Banking Waxes,” National Bureau of Economic Research, October 2018.

- Shahrokh Fardoust, Justin Yifu Lin, Xubei Luo, “Demystifying China’s Fiscal Stimulus,” The World Bank, October 2012.

- Chong-En Bai, Chang-Tai Hsieh, Zheng (Michael) Song, “The Long Shadow of China’s Fiscal Expansion,” Brookings Institution, 2016.

- Christine Wong, “The Fiscal Stimulus Programme and Public Governance Issues in China,” OECD Journal on Budgeting, 19 October 2011.

- Yinqiu Lu and Tao Sun, “Local Government Financing Platforms in China: A Fortune or Misfortune?,” International Monetary Fund, October 2013.

- “Credit to the Non-financial Sector,” Bank for International Settlements, 13 June 2022.

- Keith Bradsher, “China’s Sizzling Real Estate Market Cools,” The New York Times, 13 May 2014.

- Source: CEIC. Data as of 16 June 2021.

- Calixte Ahokpossi, “China: Capital Account Liberalization,” People’s Republic of China – Selected Issues, International Monetary Fund, 14 July 2017.

- Tom Orlik, China: The Bubble That Never Pops (Oxford University Press, 2020).

- This measure of fiscal deficit includes all elements from the International Monetary Fund’s measure of the Augmented Fiscal Deficit plus the increase in outstanding policy bank bonds. For more on the Augmented Fiscal Deficit, see Yuanyan Sophia Zhang and Steven Barnet, “Fiscal Vulnerabilities and Risks from Local Government Finance in China,” International Monetary Fund, January 2014.

- Sally Chen and Joong Shik Kang, “Credit Booms – Is China Different?,” International Monetary Fund, January 2018.

- Source: Bloomberg. Data as of 13 June 2021.

- Nicholas Lardy and Tianlei Huang, “China’s Economic Recovery Strategy Faces Challenges,” Peterson Institute for International Economics, 24 March 2020.

- Chen Jia and Li Xiang, “Proactive Fiscal Policy to Lift Growth,” The State Council of the People’s Republic of China. 23 May 2020.

- “Policy Responses to Covid-19,” International Monetary Fund. Data as of 2 July 2021.

- Cheng Siwei, Yu Hairong, Zhang Yukun, “In Depth: To Keep Stimulus Flowing, China’s Local Governments Need a Budget Fix,” Caixin Global, 21 June 2022.

- Source: CEIC. Data as of 21 June 2022.

- “People’s Republic of China: 2021 Article IV Consultation,” International Monetary Fund, 28 January 2022.

- Joseph R. Biden Jr., “Joe Biden: My Plan for Fighting Inflation,” The Wall Street Journal, 30 May 2022.

- “People’s Republic of China: 2021 Article IV Consultation,” International Monetary Fund, 28 January 2022. CEIC data as of 2 June 2022.

- “Fiscal Monitor: Fiscal Policy from Pandemic to War,” International Monetary Fund, April 2022.

- See two speeches made by Zhu Rongji after the Asian Financial Crisis: “Deepen Financial Reforms and Guard against Financial Risks” and “Truly Learn the Lessons of the Asian Financial Crisis.” English versions of these speeches are available in Zhu Rongji, June Y. Mei, Henry A. Kissinger, and Helmut Schmidt, Zhu Rongji on the Record: The Road to Reform: 1991–1997 (Brookings Institution Press, 2013).

- Adam Y. Liu, “China’s Local Government Debt: The Grand Bargain,” The China Journal, 6 December 2021.

- Nicholas Borst, “Fixing China’s Municipal Bond Market,” Seafarer Capital Partners, 14 June 2018.

- Kate Jaquet, “China’s Indebted Residential Property Development Sector,” Seafarer Capital Partners, June 2020.

- “China to Push Forward Fiscal Reform at Sub-Provincial Level,” The State Council of the People’s Republic of China, 13 June 2022.