Understanding Chinese Competition

– Nicholas Borst examines how state influence over economic competition in China shapes industries and limits overall growth.

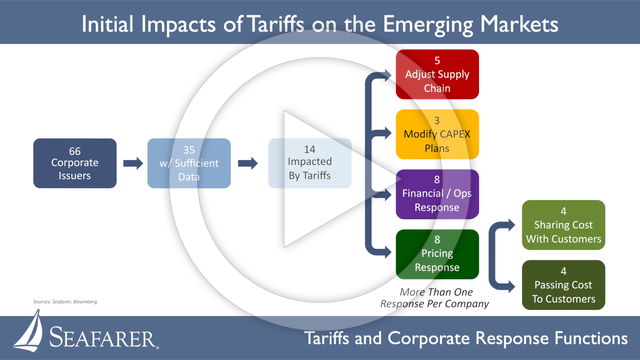

Understanding Chinese CompetitionInitial Impacts of Tariffs on the Emerging Markets

– Seafarer’s research on its portfolio holdings suggests that companies are only beginning to respond to the economic challenges posed by tariffs. While their responses are complicated and likely to evolve further, so far few EM companies seem to be footing the bill for tariffs — instead, it appears that downstream customers will bear the brunt of additional costs, at least initially.

MoreEmerging Markets Briefing

– Seafarer addresses how to invest in the emerging markets for the next decade.

MoreRevisiting the Seven Sources of Value in Emerging Markets

– Brent Clayton examines the practical lessons Seafarer’s Value team has learned in its pursuit of seven distinct sources of value in emerging markets.

MoreSurge in Dollar Convertible Bonds From Chinese Companies

– An unprecedented surge in dollar-denominated convertible bonds issued by Chinese companies warrants the attention of global investors.

MoreA Balance Sheet Approach to China

– Nicholas Borst examines China’s economic outlook and financial stability through the framework of the country’s balance sheets.

MoreThe Transparency Problem in China’s Credit Markets

– The treatment of creditors and outcomes of corporate restructurings in China’s troubled property sector pose challenges for the country’s fixed income markets.

MoreChina 2023 Outlook

– Nicholas Borst discusses recent volatility affecting Chinese stocks and highlights four underappreciated aspects of investing in China. He also examines these topics in a Letter to Shareholders.

MoreBrazil’s Fintech Revolution

– Fintech companies in Brazil are upending the country’s banking system, serving consumers in new ways, and offering millions of Brazilians their first bank accounts.

MoreCan Value Investing Work in Emerging Markets?

– Paul Espinosa reviews the evolution of the emerging markets asset class over the past 40 years. He notes that growth remains the dominant strategy employed by investors, leaving fertile ground for value investors to extract returns.

MoreCould Smaller Emerging Markets Hold Value Opportunities?

– Daniel Duncan explains why a selective value approach – not a top-down search for growth – may be well suited for finding equity returns in frontier markets.

MoreChina’s Bond Markets: Defaults and Idiosyncrasies

– Several looming corporate restructurings will show just how committed China’s regulators are to the development and healthy maturation of the country’s bond markets.

MoreHow the Value Team Finds “Gems” in Emerging Markets

– Paul Espinosa examines four company attributes that guide the Value team’s search for “Gems”: ROE-COE spread, resilience across the company life cycle, global validation, and a valuation consistent with the minimum rate of return.

MoreThe Evolution of China’s Bond Market

– The rapid development of China’s domestic bond market, now the second largest in the world, represents a significant step in the opening up of the country’s capital markets.

MoreThe Future of China within the Emerging Market Asset Class

– As China’s economic might is ever more fraught with political and moral dilemmas, Andrew Foster weighs the merits of carving out China as an independent asset class.

MoreManaging Currency Risk in the Emerging Markets

– Andrew Foster and Kate Jaquet describe how Seafarer utilizes its proprietary macro currency model to manage currency risks within the construct of a diversified portfolio of foreign securities.

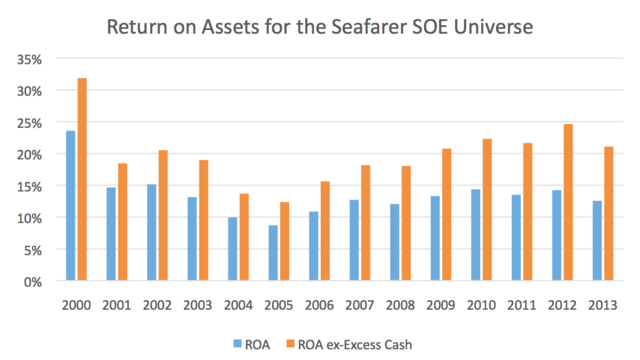

MoreNavigating the Complexities of SOEs in Emerging Markets

– Nicholas Borst, Paul Espinosa, and Andrew Foster explain that when evaluating emerging market companies, state control matters, more so than state ownership. Andrew outlines “exception” cases in which it can make sense to invest alongside a state control party, but explains that he wants to see state control decline over time, as more commercially oriented actors take greater control.

MoreChina’s Indebted Residential Property Development Sector

– As the Chinese economy faces headwinds on multiple fronts, its residential property sector – rife with opaque financing and cross-currency debt – presents risks to Chinese authorities.

MoreA Tale of Two Indices – Discussion with Steph Gan

– Steph Gan speaks with Andrew Foster about her commentary A Tale of Two Indices, which examines how countries and industries that represent the next leg of the developing world’s emergence are likely to be under-represented in leading emerging market indices.

MoreThe China Investment Dilemma

Risks for U.S. Investors During a Turbulent Time

– China’s rise as an investment destination has occurred amidst a significant deterioration in the U.S.-China relationship. Nicholas Borst examines how U.S. investors can navigate the dilemma of investing in China, a market that is too big to ignore but full of new and complicated risks.

MoreA Tale of Two Indices

– Steph Gan examines questions that are fundamental to the emerging market asset class: How are emerging market indices designed, and what are their objectives? In what manners do the benchmarks excel, and what are their limitations?

MoreState-owned Enterprises and Investing in China

– State influence over companies in China defies easy categorization and depends on both ownership levels and government policy priorities.

MoreChina’s Stock Connect – Insights from the Trading Team

– Nicholas Borst speaks with two members of Seafarer’s trading team, Chris Clayton and Alex Lusherovich, about how China’s Stock Connect program is changing the way foreign investors access the A-share market.

MoreChina’s Campaign to Develop Advanced Technologies

– Nicholas Borst speaks with Inbok Song about his white paper on China’s campaign to develop advanced technologies. Nicholas describes the government’s desire to move up the economic value chain and reduce dependency on foreign-controlled technology. He also addresses the impact of U.S.-China trade tensions on China’s technology campaign.

MoreChina’s Belt and Road Initiative

– Nicholas Borst and Steph Gan examine China’s Belt and Road initiative, the topic of a white paper written by Steph. They discuss China’s motivations behind its ambitious vision for global trade and infrastructure development, as well as the risks of the initiative.

MoreChina’s Tech Rush

How the Country’s Strategic Technology Campaign is Shaping Markets

– China’s campaign to advance its technological capabilities has the potential to transform many emerging high-tech industries through an unprecedented level of government support and cooperation with the private sector.

MoreOne Belt, One Road – Many Motives

– China’s Belt and Road initiative is an ambitious vision for global trade, infrastructure development, and diplomacy. China’s effort to elevate its international status draws on inspiration from the ancient Silk Road, but with broader territorial reach and potentially massive economic, political and social implications. The financial scale of this undertaking dwarfs the U.S. Marshall Plan in current dollar terms, but prompts key questions: how will it be funded, and who will pay for it?

MoreChanges to Chinese Currency Policy – Update

– Daniel Duncan and Andrew Foster provide an update to their August 2015 video that addressed China’s steps to liberalize how its currency trades against the U.S. dollar. Andrew notes that, just over one year later, China is rolling back some of those liberalizations. He suggests that these policy changes are signs of strained liquidity conditions, and that risks in China’s financial system are consequently elevated.

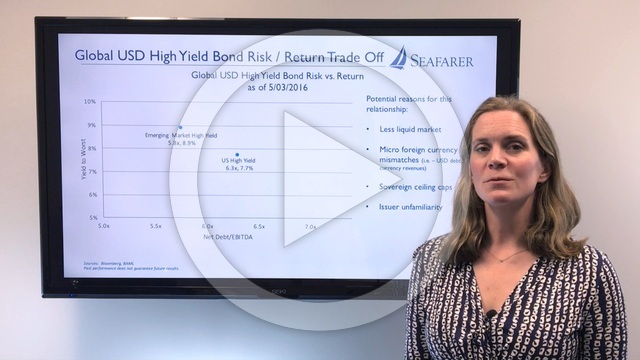

MoreHigh Yield Bonds in the Emerging Markets

– Kate Jaquet examines corporate bond opportunities in the emerging markets, comparing the credit quality and valuation of emerging market versus U.S. high yield bonds.

MoreOn Value in the Emerging Markets

– Paul Espinosa identifies seven distinct sources of value in emerging markets that may give rise to viable opportunities for long-term, value-oriented investments.

MoreRecent Market Volatility

– Daniel Duncan and Andrew Foster discuss the factors contributing to pronounced market volatility, including currency weakness in emerging markets and recent shifts in China’s currency policy.

MoreChanges to Chinese Currency Policy

– Daniel Duncan and Andrew Foster discuss recent changes to the exchange rate mechanism for the Chinese Renminbi, along with some of the potential consequences for financial markets.

MoreChina’s Emergence, In Context

– Andrew Foster admits that valuations on individual Chinese stocks are unsustainable and are likely to collapse. However, in his opinion, the overall growth of Chinese stock market capitalization does not constitute an ordinary bubble – the situation is far more complex. Andrew offers some data from history to place the evolution of China’s markets in context. He examines how the re-allocation of Chinese household wealth – away from property, and towards equities – might induce some of the Chinese market’s recent gyrations.

MoreCurrency Risk, In Context

– Andrew Foster discusses how currency risk impacts the portfolios of long-term investors in the developing world.

MoreChinese SOEs and the Way Forward

– With the introduction of the “through train” stock program, China’s A-share market is opening up to the world – and some of the state-owned enterprises that populate that market are responding by changing the way they do business.

MoreOn Mexico’s Homes

– The news from Mexico’s drug war continues to be grim. However, these horrific headlines obscure the fact that Mexico’s economy has enjoyed a degree of resilience despite the insurgent and criminal activities of the narcotics cartels. Perhaps surprisingly – and in contrast to recent U.S. experience – the local housing market has been a source of strength, benefitting from thoughtful government housing policies that have fostered stability and broadened demand. If Mexico manages to escape its current cycle of violence, the housing market may prove to be an important pillar of future growth.

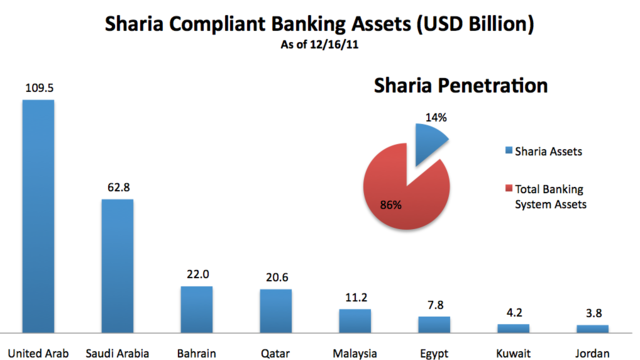

On Mexico’s HomesOn the Sharia and Islamic Finance

– The practice of banking according to Islamic principles, or “the Sharia” – the moral code and religious law of Islam – is relatively unknown within developed nations. However, in many parts of the developing world, Islamic banking is a burgeoning industry. It deserves closer scrutiny not only because it is bringing new and otherwise un-banked customers into the fold, but also because it serves as an alternative model for finance – and it may manage certain types of risk better than conventional Western models.

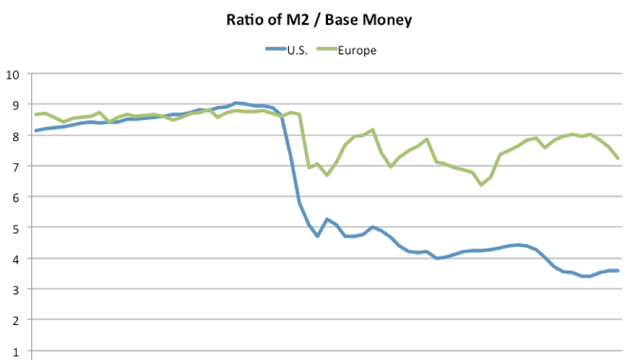

On the Sharia and Islamic FinanceOn Money and Confidence

– At my former firm, the founder once offered a simple but powerful lesson. He asserted that two basic dimensions sum up everything one needs to know about the prospective health of financial markets: money and confidence. What I understood from that conversation was that money was the lifeblood of markets, and confidence was the heart that pumps it.

On Money and ConfidenceOn Mexico’s Shores

– Drug-related violence has devastated the Mexican tourism industry, and the country as a whole. However, Mexico’s economy may yet claim a better future if a nascent trend continues: the “re-shoring” of manufacturing capacity. This commentary explores evidence that Mexico can gain market share in manufacturing industries that shifted to China over the past two decades.

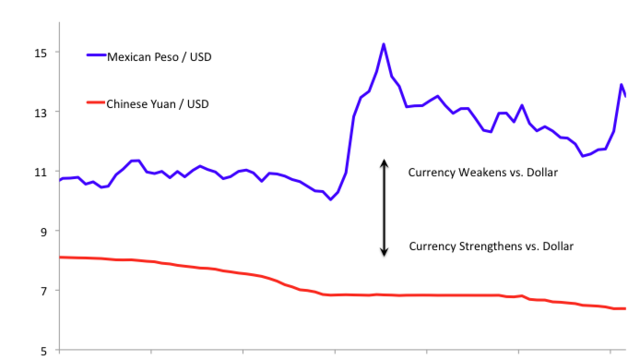

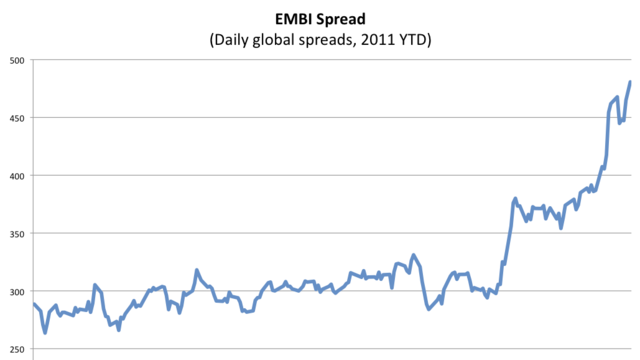

On Mexico’s ShoresOn Teflon and Emerging Market Currencies

– Some major market participants have implied that emerging market bonds – including those denominated in foreign currencies – are safe havens from the malaise of the developed world economies. EM currencies may offer desirable diversification or investment characteristics – but ultimately they remain speculative, and should not yet be accorded “safe haven” status.

On Teflon and Emerging Market CurrenciesOn Flexibility, and Why the World Needs More of It

– It has been a long and trying summer. Like everyone, I have been transfixed by the market’s wrenching descent, along with the political mayhem that has accompanied the decline. Stimulus and sovereign debt have become heated, emotional issues. However, despite prevalent rhetoric that focuses on the indebtedness of nations, I believe our primary challenge is one of growth, and not necessarily one of debt. The world needs to embrace greater flexibility in order to restore growth – and if it does not do so, I fear that equity markets will become range bound, and a sustainable recovery will prove elusive.

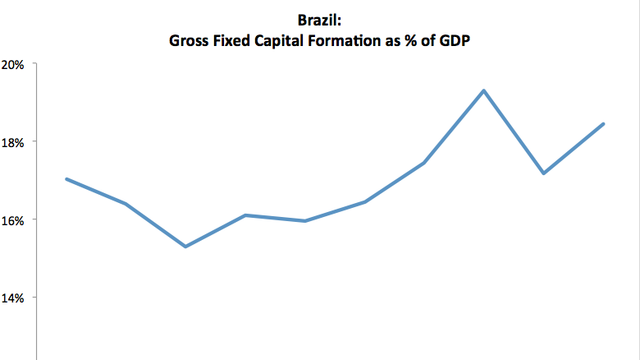

On Flexibility, and Why the World Needs More of ItOn Brazilian Investment

– In my last commentary, I suggested that Brazil’s long-term record of investment was not particularly impressive. Happily, there is a good deal of evidence that the situation is changing for the better, led by an impressive flow of foreign investment into the country. However, this change could not come too soon: Brazil must execute such investment in order to avoid the “boom-and-bust” cycles that have characterized its past.

On Brazilian InvestmentOn the Importance of Sustained Capital Investment, Part 2

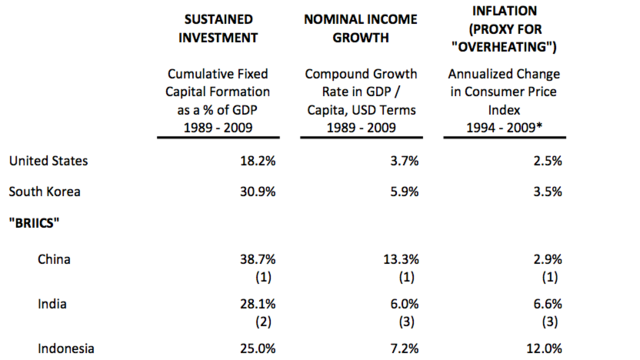

– As discussed last week, I hold a belief formed from experience: when investing in developing countries, it’s important to focus where there is careful but sustained investment in fixed capital. This commentary presents basic evidence from the “BRIICS” (Brazil, Russia, India, Indonesia, China, South Africa) in support of that assertion. I examine the implications of those countries’ long-term investment patterns, and I conclude with a brief discussion of China’s aggressive (some would say breakneck) history of investment.

On the Importance of Sustained Capital Investment, Part 2On the Importance of Sustained Capital Investment, Part 1

– When I reflect on my investment career, a few experiences stand apart from the rest. One occurred during a trip to India in 2003. During a meeting with a company there, I learned the importance of steady capital investment to sustain long-term growth. A company may appear well-run and profitable, but if it fails to invest in a consistent fashion, it is unlikely to offer the sort of scalable, sustained growth that characterizes a core holding.

On the Importance of Sustained Capital Investment, Part 1On the Uses and Abuses of Discount Rates

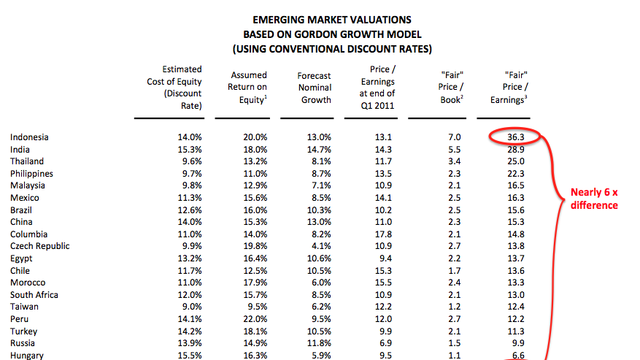

– When investors search the world for opportunity, do they value a dollar of profit from Indonesia six times more than a dollar from South Korea? I doubt they do. Yet large and misleading discrepancies can arise when investors rely heavily on discount rates in valuation models to determine the relative attractiveness of foreign assets. Discount rates are useful when determining the intrinsic value of a single asset, but in my opinion, they should not be a primary determinant in the allocation between multiple assets.

On the Uses and Abuses of Discount RatesOn China’s Provincial Finances, and the Prospect of Their Reform

– Recent reports from China suggest that the central government may clean up bad debts at domestic banks totaling over $450 billion. Those debts are primarily tied to provincial and local governments that borrowed heavily over the past two years. Despite the staggering losses, I am optimistic: China may be embarking on a new and important set of reforms.

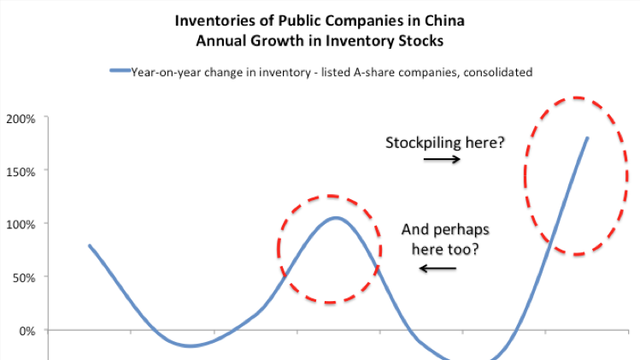

On China’s Provincial Finances, and the Prospect of Their ReformOn Stockpiling and the Commodity Cycle

– Commodity prices have surged dramatically over the past year: one broad index produced by The Economist suggests that prices have risen over 40% in dollar terms. There are a number of well-known explanations for such gains; however, I wonder whether stockpiling by companies in developing countries has exacerbated the trend.

On Stockpiling and the Commodity CycleOn Double-Invoicing and the Yuan, Part 2

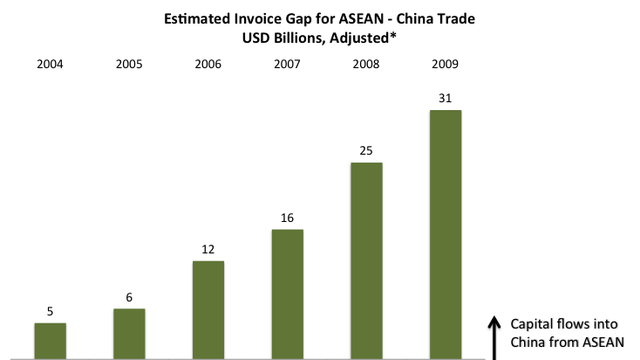

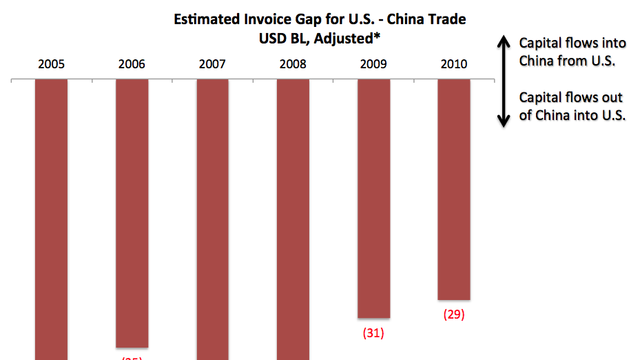

– Persistent discrepancies in China’s trade data suggest hidden capital flows into and out of the country. Double-invoicing reveals how little we really know about the yuan. We can take nothing about the yuan for granted—so approach it with caution.

On Double-Invoicing and the Yuan, Part 2On Double-Invoicing and the Yuan, Part 1

– Among global investors, it’s widely held that the Chinese yuan is a “cheap” currency, and that it is undervalued relative to the U.S. dollar. I am inclined to agree over the long-term, but I think the near-term is far more ambiguous. Empirical analysis of a little-known practice called “double-invoicing” sheds light on what some market participants think about the yuan, and it should give investors pause.

On Double-Invoicing and the Yuan, Part 1On Corporate Hedging

– Finance textbooks state company managers “are paid to take risks, but not any risks.” Managers are supposed to hedge away those risks that could jeopardize their firms’ success—like rising input prices. This seems reasonable enough in theory. I don’t buy it in practice.

On Corporate HedgingOn Persistent Inflation

– During the fall of 2009, I argued that central banks in Asia were no longer taking their cues from the U.S. Federal Reserve, and that this would stoke inflationary pressures. I was right on that count, but did not anticipate the extent to which the Fed itself would contribute to the problem. What’s next? I believe elevated inflation is here to stay—get used to it.

On Persistent InflationOn Fables, Ratings and Guarantees

– When you were young, which fable did you prefer: the farce behind the emperor’s new robes, or the comeuppance of the idle grasshopper? Though only fables, the stories hold relevance for the U.S. and Chinese bond markets, respectively.

On Fables, Ratings and GuaranteesOn the Brazilian Real

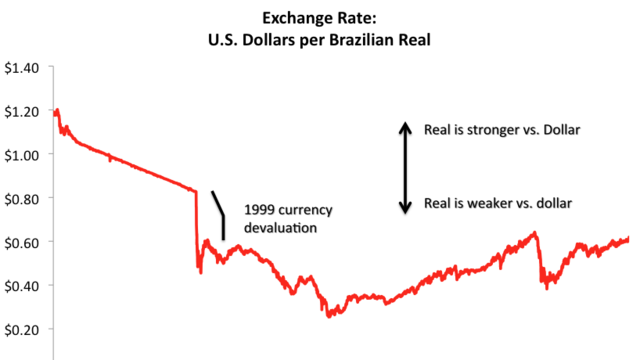

– While in São Paulo, my main impression was that of the steep valuation of the local currency. It is understandably strong, but does it rest on a strong foundation?

On the Brazilian RealOn Starting Out

– Judging from the headlines, it would seem an inauspicious time to start a company. I beg to differ.

On Starting Out