Message to Shareholders Regarding the Conflict in the Middle East

– The conflict in the Middle East is of material consequence for both investors generally and shareholders of the Seafarer Funds, and as such Seafarer is monitoring events closely. Seafarer provides a summary of the the first- and second-order exposures of the Seafarer Funds to the conflict.

MoreChina’s Competitive Shock to Global Markets

– China’s growing disruption of global industries is deeply intertwined with the country’s state-led industrial policies.

China’s Competitive Shock to Global MarketsPortfolio Review –

– Paul Espinosa notes that the Growth and Income Fund’s sources of return were diverse (consumer stocks, AI-related holdings, corporate restructurings, and dividend growth) while the EM benchmark’s return was largely driven by AI-related stocks. He discusses a new bank holding in India, and explains how the Fund seeks to mitigate adverse volatility in returns.

Portfolio ReviewPortfolio Review –

– Paul Espinosa reports that the Value Fund’s returns were driven by capital return, capital recycling, valuation, and indirect exposure to AI, and he discusses portfolio holdings in each category. Also, Paul contrasts how the Value Fund and EM benchmark generated returns in 2025 by examining the fundamental factors that contributed to performance.

Portfolio ReviewPortfolio Briefing – Fourth Quarter 2025

– Andrew Foster highlights three notable features of the Growth and Income Fund’s returns: a more diverse set of performance drivers than the EM benchmark, two value-unlocking events, and strong dividend growth. He explains that the Fund is benefiting from the propagation of artificial intelligence, but is less exposed than the benchmark to this source of return.

MorePortfolio Briefing – Fourth Quarter 2025

– Paul Espinosa reports that the Value Fund’s company-specific sources of return were uncorrelated with the EM benchmark’s sources of return. Brent Clayton introduces new Fund holdings in Brazil and India. Lastly, Paul and Brent explain where they see value opportunities in the portfolio.

MorePrevailing Winds

Learn MoreWill Tariffs Crush Chinese Export Competitiveness?

– The continued growth of Chinese exports, in the face of rising tariffs and trade barriers, remains highly uncertain.

Will Tariffs Crush Chinese Export Competitiveness?Nobody Wins in a Price War: Destructive Competition in China

– Industrial policy in China has caused overcapacity and deflation. Government interference has made the problem worse by allowing unprofitable firms to avoid bankruptcy.

Destructive Competition in ChinaChina’s Models of Competition

– China’s unique models of competition help explain why some industries flourish while others stagnate.

China’s Models of Competition

News and Commentary

Money Life – Interview with Andrew Foster

– In an interview with Money Life’s Chuck Jaffe, Andrew Foster discusses three important developments in the emerging markets: the U.S. dollar is not the dominant headwind it once was; earnings are growing for the second consecutive year; and dividends are surging. : As of September 30, 2025, Alibaba Group Holding, Ltd. comprised 3.0% of the Seafarer Overseas Growth and Income Fund. The Seafarer Funds did not own shares in the other securities referenced in this commentary. View the Seafarer Overseas Growth and Income Fund’s Top 10 Holdings. Holdings are subject to change. Listen

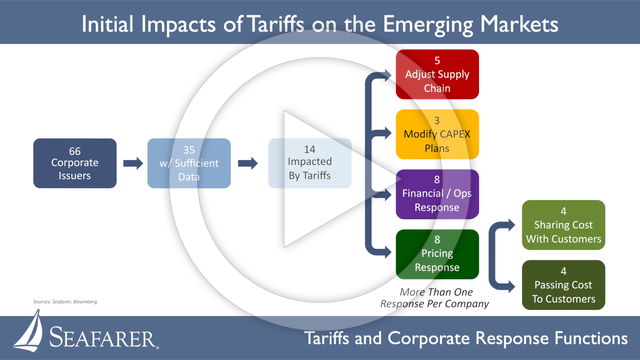

MoreInitial Impacts of Tariffs on the Emerging Markets

– Seafarer’s research on its portfolio holdings suggests that companies are only beginning to respond to the economic challenges posed by tariffs. While their responses are complicated and likely to evolve further, so far few EM companies seem to be footing the bill for tariffs — instead, it appears that downstream customers will bear the brunt of additional costs, at least initially.

MoreCo-Chief Investment Officer Update

– Paul Espinosa was named Co-Chief Investment Officer (Co-CIO) of Seafarer Capital Partners, the adviser to the Seafarer Funds. Andrew Foster, the CIO of the Firm since its founding in 2011, will remain in the role, serving as Co-CIO alongside Paul.

MessageChina Leadership Monitor – The Economic Costs of China’s Self-Sufficiency Drive

– In an article for China Leadership Monitor, Nicholas Borst explains that China’s drive for economic self-reliance comes with significant tradeoffs and, ironically, may provoke some of the risks it seeks to avoid. : As of June 30, 2025, securities mentioned in this commentary comprised the following weights in the Seafarer Overseas Growth and Income Fund: Samsung Electronics, Co., Ltd. (3.5%), and Samsung Electronics Co., Ltd. Pfd. (0.9%). As of June 30, 2025, the Seafarer Funds did not own shares in the other securities referenced in this commentary. View the Seafarer Overseas Growth and Income Fund’s Top 10 Holdings. Holdings are subject to change.

MoreThe Wire China – Interview with Nicholas Borst

– In an interview with The Wire China, Seafarer’s Nicholas Borst discusses Beijing’s approach to managing its economy: utilizing private markets while maintaining state control.

MoreFund Resources

Field Notes

Explore Our MapSeoul: The Corporate Big Leagues

– The outsized influence of South Korea’s large family-run conglomerates in daily life was driven home at the ballpark.

MoreSeoul: Taxes, and the Corporate Value-up Program

– A new national initiative in South Korea aims to improve the capital efficiency of listed corporates and bring about better treatment of minority shareholders.

MoreSão Paulo: Pharmacies on Every Corner

– Pharmacies in Brazil are becoming service hubs and occupying a more prominent role in the healthcare industry.

More